Table of Content

Would you wish to learn more about HOAIC and what they can offer you? Homeowners of American insurance coverage have multiple insurance coverage options for his or her customers. Different coverage options are available inside every supplied product, permitting customization of the insurance policies. Provides protection within the rise of construction prices after a loss, such as an increased cost of labor or materials. To qualify, you must be insured at 100 percent alternative value.

The Better Business Bureau rated Homeowners of America insurance an A+. This score was not calculated based on any of the company critiques or buyer complaints. Renters insurance protection is for purchasers that are at present renting or leasing. This type of coverage would hold your private belongings secure if a hearth, water injury, or any other catastrophe were to occur in your house.

What Insurance Merchandise Do Homeowners Of America Offer?

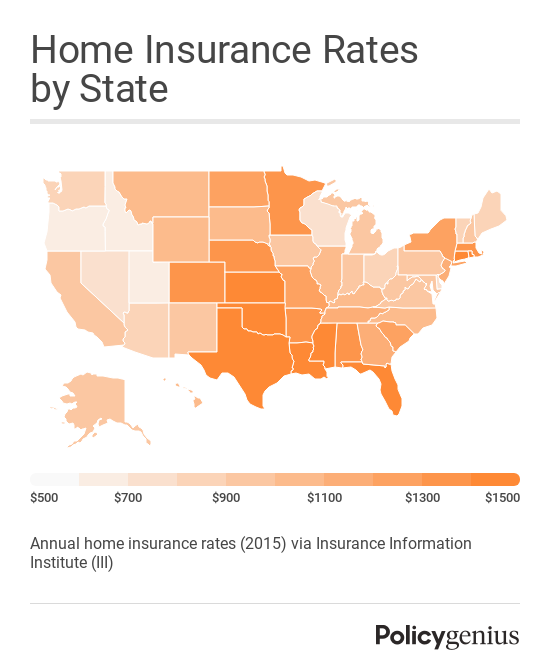

You can check the profile web page of every professional or firm to find out whether or not they are a paying advertiser (indicated by the word "sponsored"). Information is displayed initially for the advantage of customers. Overall they have aggressive rates however the pricing is variable. It depends on the protection and add-ons you choose and what state you reside in. All these components can significantly influence the pricing of you policy.

Homeowners of America Insurance Company provides a typical variety of reductions to its policyholders. However, the supply of the discounts will rely upon the state the place you reside. For example, Texas householders have all however one low cost out there to them, whereas South Carolina homeowners are restricted to 5 reductions. But if the surprising does occur, we all know it can be stressful. That’s why our experienced claims staff is on the market 24 hours a day, 7 days every week to help when you want us probably the most. We understand that what you’re really shopping for whenever you buy an insurance coverage policy is peace of mind.

Be Taught Extra About Owners Of America Insurance Coverage

She married her husband and began working within the family insurance coverage business in 2005. She became a licensed agent and wrote P&C business focusing on personal strains insurance coverage for 10 years. Laura serviced present enterprise and wrote new business. She now makes use of her insurance background to help educate... Can pay kenneling charges if you want to move out of your house quickly after a lined declare. It can also cowl vet fees or burial bills if your pet is injured or killed in a fire or other covered catastrophe.

Homeowners of America also sells renters, rental, landlord and flood insurance coverage. Homeowners who want to get an online quote or use a cell app to handle their policies won’t have these choices with Homeowners of America. We consider everyone should be ready to make financial selections with confidence.

Does Householders Of America Have Good Reviews?

The firm did receive an A rating for financial stability from Demotech, a different score service. Provide a complete range of protection options, making it easy for policyholders to protect their investment. Its stellar market status is owed to its attributes like good discounts, payment plans, and fast claim processing. This insurance protects the items in your house, like your furnishings. If they're damaged or lost, private property coverage may allow you to cover the value of changing them. A main drawback to Homeowners of America is its restricted availability.

Below are additional coverages offered by this enterprise. The algorithm also takes into consideration the percentage of what prospects say Homeowners of America Insurance does well vs. the proportion of what customers say the company could do higher. Like any insurance coverage company, Homeowners of America has its benefits and its disadvantages.

Our Customer Service

See the state Homeowners of America Insurance sells in below and click on on the hyperlink to see how Homeowners of America Insurance compares to the opposite prime corporations in that state. Don’t accept Homeowners of America or any other insurance without exploring your options. Enter your ZIP code to get a free homeowners insurance quote right now. US Insurance Agents works hard to offer our users with a quick and easy way to get and compare insurance charges for multiple strains of insurance.

Offers a extra generous payout if your belongings are stolen or destroyed. With this coverage, the insurer can pay enough so that you can buy brand-new replacements for the lost items. Without this coverage, you’d receive less of a payout for older items because they’ve misplaced worth over time. If you’re apprehensive about your pet, this will cover kenneling within the occasion that your liked ones is briefly displaced.

Add this coverage to your coverage in case you are concerned about id theft. This coverage provides up to $15,000 in reimbursement to the policyholders for legal charges and different relevant expenses that may come with identification theft. This coverage is 2% of your dwelling coverage and 10% in Texas.

We will cowl every little thing from what insurance coverage insurance policies are provided to what discounts the corporate could have. The limit for personal liability is from $25,000 to $500,000. Personal liability coverage doesn’t offer motorcar legal responsibility. Homeowners of America has attractive and low insurance charges, which is usually why policyholders decide to do business with the company. However, in relation to homeowners insurance coverage claims, Homeowners of America policyholders are far from happy by its service.

This add-on coverage offers $5,000 worth of safety for the property like jewellery, fur, and watches in the occasion of a lined loss. If you want extra details about the protection options, you can contact the company’s agent. Also, notice that coverage choices and discounts differ from state to state. Offers coverage limits that are enough for most individuals looking for a house insurance policy with a limit ranging from $50,000 to $750,000. Explore householders insurance rates by ZIP code to make a well-informed choice about your coverage. To get began, enter your ZIP code and compare owners insurance coverage charges at present.

No comments:

Post a Comment